30+ reverse mortgage credit score

A good credit score isnt crucial to secure a reverse mortgage and a bad credit score. Thes most popular type of reverse mortgage also offers the most flexibility.

Reverse Mortgage Calculator

Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator.

. Other important factors include your loan type loan term eg. Updated FHA Loan Requirements for 2023. Web As part of HUDs 2015 rollout of Financial Assessment every lender must now examine every applicants credit history and property charge history as well as their.

Ad Looking For Reverse Mortgage Calculator. Ad We fill in the gaps that other credit score providers simply dont. The 30-year fixed-rate mortgage was 322 in early January 2022.

Be at least 62 years old Have zero delinquencies on any federal debt Own your home free and clear or have 50. Access to all 3 Credit Scores now is more important than ever. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

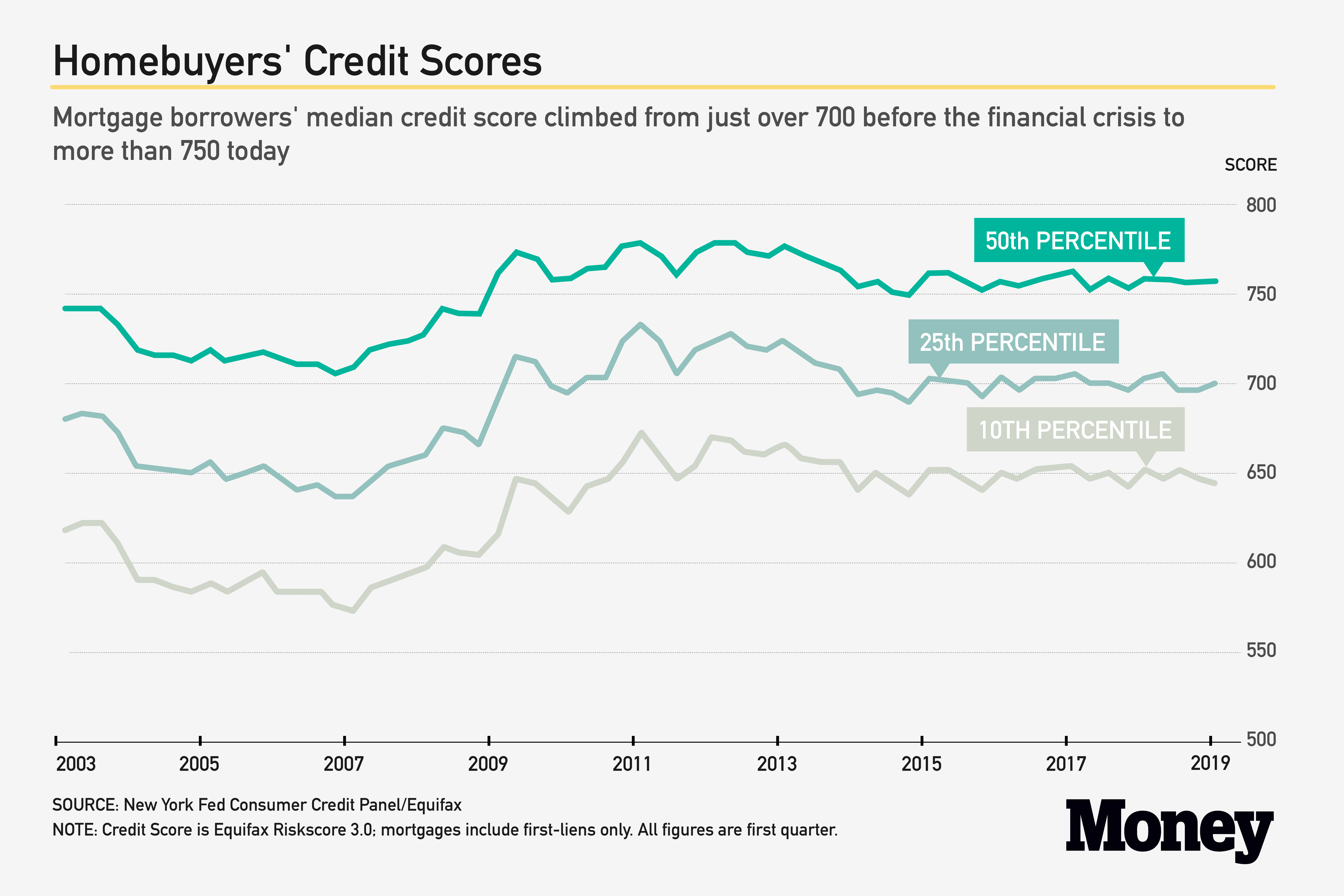

What Borrowers Should Know. Web Your credit score is only one factor that goes into determining your mortgage rate. The average rate for a 15-year fixed mortgage is 633 which is an increase of 11 basis points compared to a week ago.

Web Reverse Mortgages and Credit Scores. The answer is no. Ad Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage.

However using the funds to pay off other debts may positively affect your credit reports and can. HECMs are insured by the FHA and are limited to a maximum. If your credit is not deemed satisfactory the lender will.

Web A reverse mortgage is meant for homeowners who have paid off their mortgage or who have accumulated a lot of home equity. Web A reverse mortgage does not affect your credit score on its own. Web There is no minimum credit score to qualify for a reverse mortgage but your credit history may affect your eligibility.

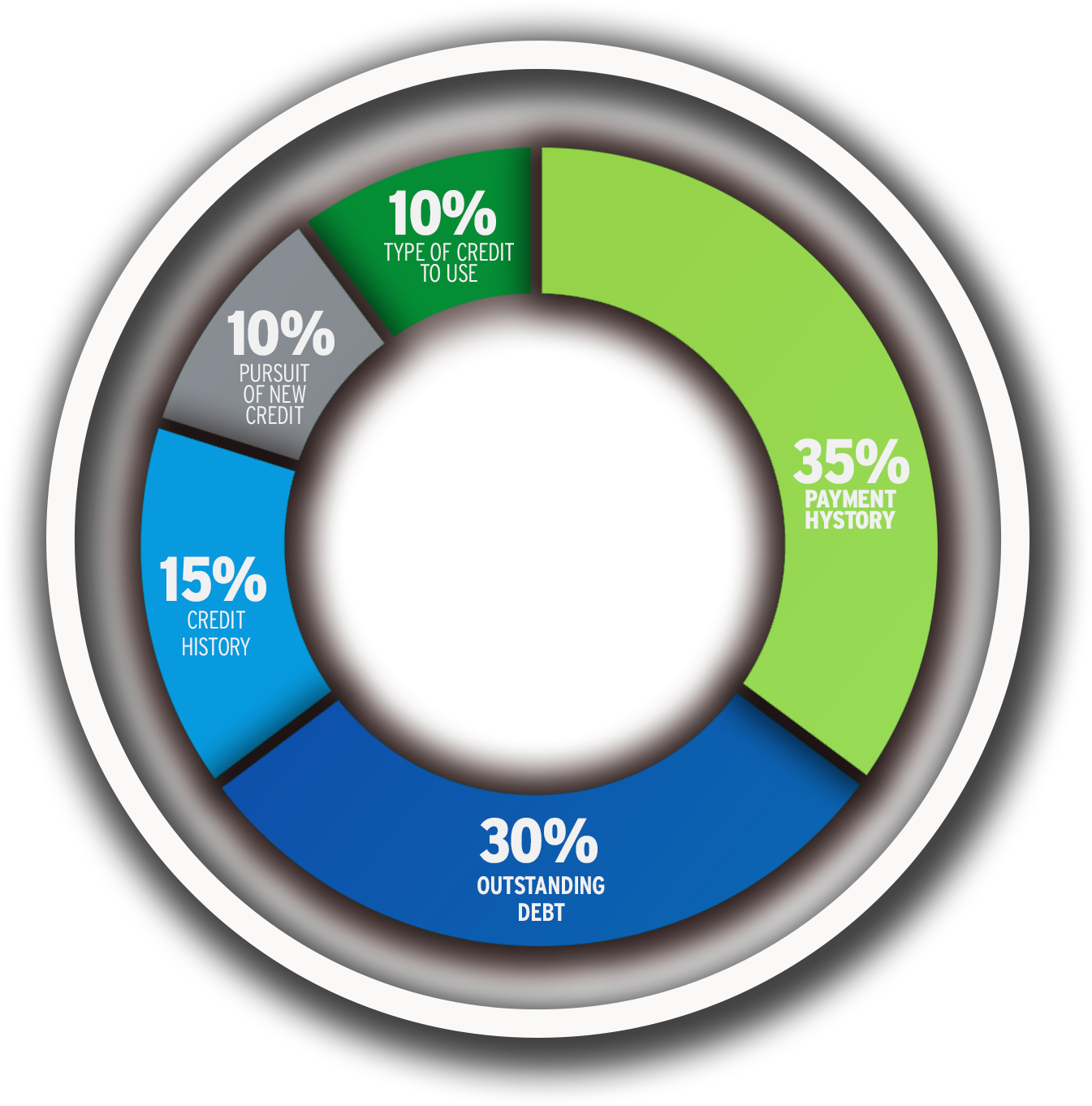

Web Low Credit Score Costs On a 30-year fixed-rate mortgage for 150000 having a credit score of 620 to 639 could cost you tens of thousands of dollars more. Web Mortgages help your credit score by improving your mix of revolving debt to installment debt. This mix accounts for roughly 10 of your score.

Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Web The lending industry carves up the credit score scale into 20-point increments and adjusts the rates it offers borrowers each time a credit score moves up or down by about 20 points. Web 12 hours agoFactor like your credit score and debt-to-income ratio.

Ad While there are numerous benefits to the product there are some drawbacks. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Reverse mortgages frequently are marketed to.

Web General reverse mortgage requirements include the following. Youll need a 580 credit score to make the minimum 35 down payment. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

Compare a Reverse Mortgage with Traditional Home Equity Loans. Web So can a reverse mortgage affect your credit. Get The Best Estimate Of Your Loan With A Reverse Mortgage Calculator.

30 or 15 years and. Web Credit score providers look at that differently than someone who might have many recent credit inquiries in different areas cars mortgages credit lines and credit cards etc. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Since then mortgage rates have risen. Web Reverse mortgages with good credit If you are above the LESA thresholds in good fiscal shape and are meeting all of your obligations the lender will not require a. Web 15-year fixed-rate mortgages.

Web Youll usually need a credit score of at least 620 to refinance and if you want to get the best interest rates your score needs to be about 100 points higher. Web A lender can consider a borrower to have satisfactory credit as long as theyve made all housing and installment debt payments on time for the previous 12 months have no more. Web Home equity conversion mortgage.

But if you use the funds obtained through the reverse mortgage to pay off other debt you can. Ad Take the First Step Towards Your Dream Home See If You Qualify. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

Check Your Official Eligibility Today. Web The FHA minimum credit score is 500 with a down payment of 10 or more.

![]()

5 Factors That Affect Your Mortgage Application Homewise

Money Management For Your Financial Well Being

Reverse Mortgage What It Is How Seniors Use It Nerdwallet

Brett Stumm Reverse Mortgage Solutions Medical Expenses

Happy United Nations Day Katherine Carlay Sr Loan Officer Reverse Mortgage Specialist

What Is A Reverse Mortgage Christine Beardslee Recruiter Loan Originator Rev Mtg Specialist

This Is The Credit Score You Need For A Mortgage Money

What Is The Minimum Credit Score For Reverse Mortgage Financing

Credit Ratings And Hecm Terms Reverse Mortgage Guide Section 2 Article 3 Hsh Com

How To Improve Your Credit Score Stacy Jetton Sr Mortgage Broker

2021 Reverse Mortgage Limits Soar To 822 375

What Is A Reverse Mortgage Christine Beardslee Recruiter Loan Originator Rev Mtg Specialist

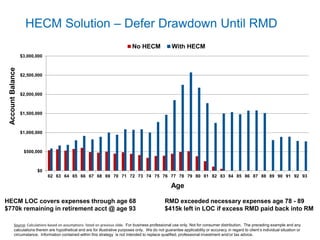

Encore Financial S Hecm Reverse Mortgage Presentation

Reverse Loan Josh Bartlett Loan Originator

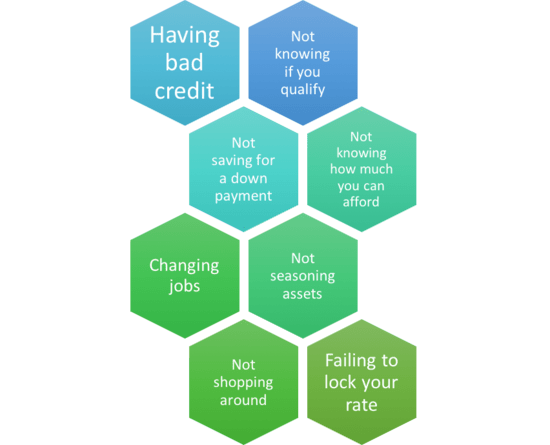

Top 10 Mortgage Mistakes To Avoid For A Smooth Home Loan Experience

Can I Get A Reverse Mortgage With Bad Credit Senior Lending

2k Los Shari Kamburoff Mortgage Loan Officer